Intermarkets' Privacy Policy

Donate to Ace of Spades HQ!

aceofspadeshq at gee mail.com

Buck:

buck.throckmorton at protonmail.com

CBD:

cbd at cutjibnewsletter.com

joe mannix:

mannix2024 at proton.me

MisHum:

petmorons at gee mail.com

J.J. Sefton:

sefton at cutjibnewsletter.com

The "Moderate Democrat" Governess of Virginia Is Responsible for the Murder of Stephanie Minter and People Are Noticing

Trump Eases Kristi Noem Out of DHS Spot, Promoting Her Downwards to Head an Agency No One Ever Heard Of

Trump Wins Major, Major 9-0 Win at Supreme Court: Lowly Lawless District Court Justices Must Defer to Immigration Judges

Schmolls: Trump's Second Term Approval Is Higher Than That of the "Popular" Barack Obama and George Bush Too

The Morning Rant

Mid-Morning Art Thread

The Morning Report — 3/5/26

Daily Tech News 5 March 2026

Wednesday Overnight Open Thread - March 4, 2026 [Doof]

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

maildrop62 at proton dot me

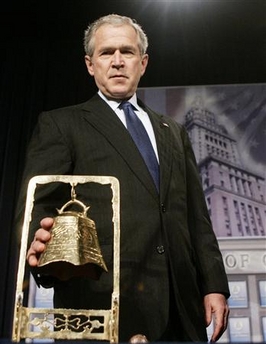

Cowbell

Unemployment drops to 4.5%; previous monthly employment gains adjusted upwards (of course).

The nation's unemployment rate dipped to 4.5 percent in February even as big losses of construction and factory jobs restrained overall payroll growth. Wages grew briskly....

[J]ob gains in the previous two months turned out to be stronger than previously estimated. Employers added 226,000 new jobs in December, versus the 206,000 last estimated. Payrolls grew by 146,000 in January, up from a previous estimate of 111,000.

The new tally of jobs added to the economy in February was close to economists' forecast for a gain of around 100,000. They had predicted the unemployment rate would hold steady at 4.6 percent.

Workers' wages grew quickly last month.

Average hourly earnings rose to $17.16, a 0.4 percent increase from January. That was slightly faster than the 0.3 percent gain economists were expecting. Over the 12 months ending in February, wages grew by 4.1 percent.

Strong wage growth is welcome by workers and supports consumer spending, a key ingredient to the country's economic health. But a rapid pickup - if sustained and not blunted by other economic forces - can raise fears about inflation. Spiraling inflation would whittle away any wage gains, hurting workers' wallets, and isn't good for the overall economy, either.

Trade deficit shrinks due to "record-breaking" exports:

The US trade deficit narrowed 3.8 percent in January to 59.1 billion dollars thanks to record-breaking export growth, the Commerce Department said Friday.It was a bigger drop than expected on Wall Street, where analysts saw a deficit of 60.0 billion dollars, and marked the steepest change in the trade figure since October.

An improving trade picture could be good for first-quarter US economic growth, as a higher deficit subtracts from gross domestic product.

US households' net worth "skyrockets:"

he net worth of U.S. households climbed to a record high in the final quarter of last year, boosted mostly by gains on stocks, the Federal Reserve reported Thursday.Net worth — the difference between households' total assets, such as houses and bank accounts, and their total liabilities, such as mortgages and credit card debt, totaled $55.6 trillion in the October-to-December quarter.

That marked a 2.5 percent growth rate from the third quarter, the previous quarterly record high. Stocks gains helped fuel the increase in net worth, although real-estate gains played a role, too.

For all of last year, households' net worth rose by 7.4 percent, a slower pace than the 7.9 percent increase registered in 2005.

...

Economists said Thursday's report suggest households' finances are holding up fairly well to any strains caused by the troubled housing market and well as some sluggishness in overall economic growth. Analysts said that's because the jobs climate remains in good shape and income growth has picked up.

A lot of jobs were cut in the construction sector, and some more in the factory sector, all due to the slow in home-building, but no one ever expected that to continue forever. Most worry that boom went on unsustainably long. In any event, those losses were offset by gains in other sectors.

I've been trying to find a forgotten hottie from the eighties. Alas, the internet, too, has forgotten them. This is the best I can do. Jennifer Runyon, the blonde chick who is clearly not really a blonde but somehow really makes that work to her advantage:

And a little beefcake:

"Hey, Brian Williams? Eat me. And David Gregory

can play with my pickle while you do."

steevy: "OT but hilarious, apparently the Iranians have exe ..."

whig: "Why is it that these judges et. al. are allowed to ..."

CaliGirl: "Nood ..."

Accomac: "Poor Tottenham ..."

Skip: "Goid, tired of hearing about Tucker ..."

Chuck Martel: ""This comes up so often here. It is a fallacy. Men ..."

18-1: "[i]Manson had a much clearer vision of the future ..."

buddhaha: "Lets try this again, and proofread better, dammit! ..."

CaliGirl: "234 I swear, the rural/small town-urban divide in ..."

gKWVE: "[i]If you believe the numbers the lilly white CIA ..."

Chuck Martel: "I wonder if you could crowdsource a lawsuit by Min ..."

The "Moderate Democrat" Governess of Virginia Is Responsible for the Murder of Stephanie Minter and People Are Noticing

Trump Eases Kristi Noem Out of DHS Spot, Promoting Her Downwards to Head an Agency No One Ever Heard Of

Trump Wins Major, Major 9-0 Win at Supreme Court: Lowly Lawless District Court Justices Must Defer to Immigration Judges

Schmolls: Trump's Second Term Approval Is Higher Than That of the "Popular" Barack Obama and George Bush Too

The Morning Rant

Mid-Morning Art Thread

The Morning Report — 3/5/26

Daily Tech News 5 March 2026

Wednesday Overnight Open Thread - March 4, 2026 [Doof]

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Democratic Forays into Erotica

New Shows On Gore's DNC/MTV Network

Nicknames for Potatoes, By People Who Really Hate Potatoes

Star Wars Euphemisms for Self-Abuse

Signs You're at an Iraqi "Wedding Party"

Signs Your Clown Has Gone Bad

Signs That You, Geroge Michael, Should Probably Just Give It Up

Signs of Hip-Hop Influence on John Kerry

NYT Headlines Spinning Bush's Jobs Boom

Things People Are More Likely to Say Than "Did You Hear What Al Franken Said Yesterday?"

Signs that Paul Krugman Has Lost His Frickin' Mind

All-Time Best NBA Players, According to Senator Robert Byrd

Other Bad Things About the Jews, According to the Koran

Signs That David Letterman Just Doesn't Care Anymore

Examples of Bob Kerrey's Insufferable Racial Jackassery

Signs Andy Rooney Is Going Senile

Other Judgments Dick Clarke Made About Condi Rice Based on Her Appearance

Collective Names for Groups of People

John Kerry's Other Vietnam Super-Pets

Cool Things About the XM8 Assault Rifle

Media-Approved Facts About the Democrat Spy

Changes to Make Christianity More "Inclusive"

Secret John Kerry Senatorial Accomplishments

John Edwards Campaign Excuses

John Kerry Pick-Up Lines

Changes Liberal Senator George Michell Will Make at Disney

Torments in Dog-Hell

The Ace of Spades HQ Sex-for-Money Skankathon

A D&D Guide to the Democratic Candidates

Margaret Cho: Just Not Funny

More Margaret Cho Abuse

Margaret Cho: Still Not Funny

Iraqi Prisoner Claims He Was Raped... By Woman

Wonkette Announces "Morning Zoo" Format

John Kerry's "Plan" Causes Surrender of Moqtada al-Sadr's Militia

World Muslim Leaders Apologize for Nick Berg's Beheading

Michael Moore Goes on Lunchtime Manhattan Death-Spree

Milestone: Oliver Willis Posts 400th "Fake News Article" Referencing Britney Spears

Liberal Economists Rue a "New Decade of Greed"

Artificial Insouciance: Maureen Dowd's Word Processor Revolts Against Her Numbing Imbecility

Intelligence Officials Eye Blogs for Tips

They Done Found Us Out, Cletus: Intrepid Internet Detective Figures Out Our Master Plan

Shock: Josh Marshall Almost Mentions Sarin Discovery in Iraq

Leather-Clad Biker Freaks Terrorize Australian Town

When Clinton Was President, Torture Was Cool

What Wonkette Means When She Explains What Tina Brown Means

Wonkette's Stand-Up Act

Wankette HQ Gay-Rumors Du Jour

Here's What's Bugging Me: Goose and Slider

My Own Micah Wright Style Confession of Dishonesty

Outraged "Conservatives" React to the FMA

An On-Line Impression of Dennis Miller Having Sex with a Kodiak Bear

The Story the Rightwing Media Refuses to Report!

Our Lunch with David "Glengarry Glen Ross" Mamet

The House of Love: Paul Krugman

A Michael Moore Mystery (TM)

The Dowd-O-Matic!

Liberal Consistency and Other Myths

Kepler's Laws of Liberal Media Bias

John Kerry-- The Splunge! Candidate

"Divisive" Politics & "Attacks on Patriotism" (very long)

The Donkey ("The Raven" parody)