Intermarkets' Privacy Policy

Donate to Ace of Spades HQ!

aceofspadeshq at gee mail.com

Buck:

buck.throckmorton at protonmail.com

CBD:

cbd at cutjibnewsletter.com

joe mannix:

mannix2024 at proton.me

MisHum:

petmorons at gee mail.com

J.J. Sefton:

sefton at cutjibnewsletter.com

Washington's Birthday Cafe

Quick Hits

Revealed: The Erotic Poetry of... Eric Swalwell?

The Media Whined That the Washington Post Cancelled Its World-Beating Sports Section.

The Media, You Will Not Be Surprised to Learn, Lied

RFKJr. Reveals Harrowing Evidence About the Extent of California Fraud

Leftists: Replacement Theory is a White Nationalist Conspiracy Theory

Also Leftists: The English Countryside Is Too White So We Have to Move Minorities and Migrants Into It

CNN Pollster: An All-Time High of American Voters, 58%, Say Democrats are "Too Liberal"

Rubio and AOC Offer Competing Visions of Foreign Policy, Realist Vs. Retard

THE MORNING RANT: The SBA Will Stop Lending to Non-Citizens

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

maildrop62 at proton dot me

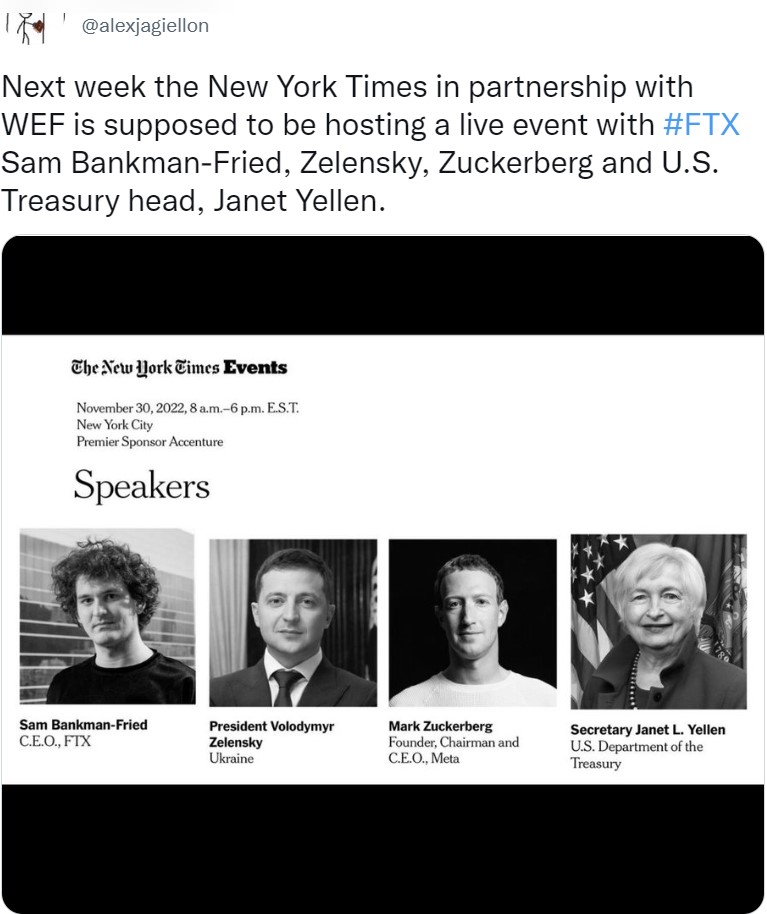

Sam Bankman-Fried of FTX: Yeah, We Just Say The Right Woke "Shibboleths" So That People Think We're Good Guys

By the way, he was giving money to Vox. That was part of the "altruism" he was doing, the woke crap he was doing to make people on the left think he was a "good guy."

He gave money to a bunch of media companies on the left.

The New York Times is so enamored with Bankman-Fried's "right shibboleths" that they just ran a puff piece on the disgraced hustler that is so disgracefully fawning that even the leftwing Gizmodo can see through it.

Was the New York Times getting money from Bankman-Fried too?

What SBF (how Sam Bankman-Fried is usually called) was doing was this, if I understand it right: people were keeping their crypto on his exchange, FTX. He was taking their money and "lending" it to his other company, Almeda. Almeda in turn was investing that money -- and lost about $4 billion.

Now, SBF is claiming he didn't take the crypto people had on deposit with FTX and use it to play the stock market. Because he's claiming a very thin technicality: No, he didn't use their money for that. He lent their money to Almeda, deposited an IOU in their account payable from Almeda, and then had Almeda gamble with the borrowed funds.

The problem comes when Alemda loses the money and can't pay those IOUs which are now sitting, worthlessly, in people's crypto accounts in place of their actual crypto coins.

I don't know if this is illegal or scammy or what, but it sure seems like it's bad. And it sure seems like the sort of edgeplay advantage-taking that the New York Times would usually blast a Financial Fat-Cat for engaging in.

But here, the New York Times is... oddly defensive on behalf of SBF, and finds his claims and explanations strangely plausible.

I'm sure that this doesn't have anything to do with the fact that SBF is the second-largest donor to the Democrat Party after George Soros, and a huge donor to the media.

FTX filed for bankruptcy on Friday, leaving reasonable people to wonder how a cryptocurrency platform founded in 2019, which reached a valuation of $32 billion in 2021, could plummet to zero in such a short time. There's a new piece in the New York Times which gained exclusive access to FTX founder Sam Bankman-Fried, but if you're looking for answers, you're not going to find it there. In fact, the interview with SBF, as he's often called, is presented with such a gauzy lens that you have to start wondering what the hell is going on with crypto reporting at the Times.The new article in the New York Times by David Yaffe-Bellany lays out the facts in ways that are clearly beneficial to SBF's version of the story and leaves many of his highly questionable assertions without proper context or even the most minimal amount of pushback. The result isn't to illuminate the shadowy world of crypto. It reads like if the Times had conducted an interview with Bernie Madoff after his ponzi scheme collapsed and ultimately suggested he just made some bad investments.

As one example, take a paragraph near the beginning of the article that quotes SBF's dealings with hedge fund Alameda Research, the sister organization of FTX, run by SBF's sometime romantic partner Caroline Ellison. The paragraph, one of just a few about Alameda, brushes past all the most important facts that have been reported by outlets like Reuters, Bloomberg News, and the Financial Times.

From the New York Times:

Alameda had accumulated a large "margin position" on FTX, essentially meaning it had borrowed funds from the exchange, Mr. Bankman-Fried said. "It was substantially larger than I had thought it was," he said. "And in fact the downside risk was very significant." He said the size of the position was in the billions of dollars but declined to provide further details.SBF's quote about "borrowing" billions between FTX and Alameda seems to be a wild mischaracterization, if we're to believe reliable reporting by numerous other outlets, and paints the corporate three-card-Monte as some kind of innocent investment move gone wrong. At least $4 billion of FTX funds, including customer deposits, were moved to prop up Alameda, according to Reuters, and that's just something you can't do legally.

The billionaire CEO of Citadel, Ken Griffin, explained just today at a conference in Singapore why moving money in this way isn't allowed in traditional finance.

Yeah I don't know anything about finance or investing but it seems to me that you probably can't take clients' money without their permission and gamble it for your own benefit and hope that you make money with it so that you can later restore it to their accounts. I know that sometimes lawyers do this, and these lawyers are, what's the word, disbarred and sometimes prosecuted.

Because, you know, it's not your money. I can't steal money out of your wallet, place a bet at the track with it hoping I'll win and then I can pocket the profit and return your original "stake," and then when I lose your money, tell you, "Bad news, Bruv -- Little Suzy's going to have to go to state school now. We got straight-murked by a slow-footed nag called Desdemona's Derriere in the fifth at Belmont."

Earlier in the piece, the Times calls what happened to FTX a "run on deposits," a characterization that obscures what really occurred.

You'll have to read the article for this, but it does sound like the New York Times is essentially lying on behalf of SBF. What it sounds like is that SBF had phantom assets which simply did not exist in any way. The article mentions FTX holding $2.2 billion in a crypto coin they themselves invented called Serum, but then saying that in the entire world, all of the Serum coins were only valued at $88 million.

So... it sounds like they're saying that the claims that their stock of Serum being worth $2.2 billion are, what's the word, a grotesque fiction which the law would call "fraud." So when someone asks to be paid off, they're not able to be paid off -- for the similar reasons the producers in The Producers couldn't pay off their backers. Because it was a scam.

I'm not sure about that part, though. I am reasonably sure that $2.2 billion is not equal to $88 million, but beyond that, my math airplane overruns my financial landing strip.

Gizmodo writes that the New York Times strains to make SBF's "oopsie" sound like this was all just a problem of being too concerned with "effective altruism" and not concerned enough with the balance sheets.

Mr. Bankman-Fried's circle of colleagues was bound by a commitment to effective altruism, a charitable movement that urges adherents to give away their wealth in efficient and logical ways. For co-workers outside the clique, it was sometimes difficult to get time speaking with Mr. Bankman Fried, a person familiar with the matter said. And Mr. Bankman-Fried made it a point of pride that FTX had only about a 300-person staff, much smaller than its top rivals, Binance and Coinbase.Even as he kept hiring down, Mr. Bankman-Fried built an ambitious philanthropic operation, invested in dozens of other crypto companies, bought stock in the trading firm Robinhood, donated to political campaigns, gave media interviews and offered Elon Musk billions of dollars to help finance the mogul's Twitter takeover.

Mr. Bankman-Fried said he wished "we'd bitten off a lot less."

So as you can see, SBF was just too much of a stars-in-his-eyes idealist and altruistic hippie who wasn't keeping close enough watch on dollars and cents because that's something money-grubbing capitalists do, not "effective altruists" like himself.

You know, like the Beatles with Apple Corp.

I remember when Paul McCartney stole $4 billion from the accounts of his depositors and lost it all when he lent it to a sister corporation gambling in the stock market. He wrote a song about it. It was called "Admiral Halsey/Uncle Albert." ("We're so sorry, Uncle Albert...")

You know, Gizmodo is usually a trash outlet, but I'm gonna have to say, that piece is worth your time.

To top it all off, the Times article never addresses the fact that FTX was allegedly "hacked" over the weekend to the tune of roughly $600 million. Not even a passing mention of this very bizarre thing that will surely have a big impact on the bankruptcy proceedings moving forward.

Yeah, about that, huh?

#HACKED! That's weird, huh No questions about that, New York Times?

Regarding those Serum bitcoins that FTX invested: So, this explains it.

And makes it worse.

In a post entitled Magic Beans? In This Economy?, Rusty Foster links this piece by Matt Levine, examining FTX's balance sheet.

FTX claimed $9.6 billion in assets vs. $8.9 billion in liabilities, so, $700 in the black, but here's the problem: $8 billion of those "assets" come in the form of SBF's own self-evaluation of what he thought his assets were worth -- and he evaluated them flatly at $8,000,000,000, a nice big round number -- and his assets included "little-traded" niche bitcoins, such as Serum, which he himself invented.

And note that he claimed that his private stock of the Magical Bean bitcoin he invented -- well, it's a joke that it's a Magical Bean bitcoin, though I'm sure someone will make up a Magical Bean bitcoin; it's called Serum -- he's claiming the Serum he owns is worth $2.2 billion, whereas people not called Sam Bankman-Fried evaluate all the Serum in all the world at $88 million, all-in, tops.

So... he is obviously wildly overestimating the value of his assets. What is the Serum he holds actually worth? Maybe $70 million? Less?

Here is Levine, then Foster commenting, then Levine again:

[Levine:]$16 billion of dollar liabilities and assets consisting mostly of some magic beans that you invented yourself and acquired for zero dollars? WHAT? Never mind the valuation of the beans; where did the money go? What happened to the $16 billion? Spending $5 billion of customer money on Serum would have been horrible, but FTX didn't do that, and couldn't have, because there wasn't $5 billion of Serum available to buy. FTX shot its customer money into some still-unexplained reaches of the astral plane and was like "well we do have $5 billion of this Serum token we made up, that's something?" No it isn't!

[Foster:]If you want to understand what happened to FTX, and by extension what the last couple years of "innovation" in crypto finance has been about, this is a good Money Stuff to read. My extremely condensed summary is: FTX's value was mostly denominated in numbers like "$8,000,000,000" and "$2,187,876,172" which Sam Bankman-Fried just made up and wrote down in a spreadsheet. That's not a complete description of the mechanism used to make up the numbers, but it is a full accounting of the real economic value created. The reason for making up those spreadsheet numbers was to attract and then steal customer deposits of actual money.

[Levine:] If you try to calculate the equity of a balance sheet with an entry for HIDDEN POORLY INTERNALLY LABELED ACCOUNT, Microsoft Clippy will appear before you in the flesh, bloodshot and staggering, with a knife in his little paper-clip hand, saying "just what do you think you're doing Dave?" You cannot apply ordinary arithmetic to numbers in a cell labeled "HIDDEN POORLY INTERNALLY LABELED ACCOUNT." The result of adding or subtracting those numbers with ordinary numbers is not a number; it is prison.

Emphases added by me.

Nasdaq.com rips the New York Times for "complicity" with SBF:

The article, written by Times crypto beat reporter David Yaffe-Bellany (with contributions by industry legends including Erin Griffith and Ephrat Livni), has been widely slammed as a "puff piece.""At the same time they were pumping the FTX scam, they were writing defamatory gossip pieces about industry stalwarts, driving their audiences away from safe, reliable and proven venues," Kraken ex-CEO Jesse Powell said, presumably referring to his exchange and Coinbase, which have been center to a few media storms.

"Disgusting complicity on the part of the New York Times. He has ruined countless people's lives by theft and fraud, and NYT is now helping him to delay or evade justice by whitewashing him in their prestigious, influential newspaper. I doubt this is just a mistake on their part," Zcash co-creator Zooko Wilcox said.

...

The media, perhaps especially crypto-native publications, is complicit in the rise of Bankman-Fried.

Ashley Rindsberg of Tablet writes that SBF played -- and paid -- the media, and the media in return made him a star and a "safe" place to deposit your money.

She begins by noting all the Usual Leftwing Media suspects have heaped praise on his oddly unconventional billionaire and his devotion to Effective Altruism.

I'll just mention this:

CNBC star Jim Cramer once compared Bankman-Fried, who has been active in crypto finance for only a handful of years, to John Pierpont Morgan, the giant of industry who worked in banking for nearly four decades before striking out on his own.

... because you can't have a major financial meltdown without Jim Cramer telling people to pour their life savings into it.

I'll refer you to her article for the rest of it.

She notes that the same media outlets that spent the last two years hyping SBF as the Great Leftwing Capitalist Avenger are, naturally, still covering for him, now that he's exposed as a degenerate swindler.

The New York Times, most prominently, but hardly exclusively.

Then Rindsberg turns to the demonstration of Sam Bankman-Fried's "effective altruism" most appreciated by the media -- his direct payoffs to the media itself.

With all of the puff pieces from the press, there was apparently little interest in investigating SBF's web of interlocking firms. A number of high profile outlets best known for investigative reporting took money from Bankman-Fried--in some cases money earmarked to fund investigative journalism--and yet did little, it appears, to investigate the source of those funds.This was the case with a $5 million pledge to ProPublica from Bankman-Fried's family foundation, Building a Stronger Future. Vox, which published a March 2021 interview with Bankman-Fried, introduced the FTX founder by praising his "civic-mindedness," which was guided by an algorithmlike statement of purpose: "Make a tremendous amount of money by any means necessary. Then give it all away by the best means possible." Perhaps their praise paid off: In a recent article on the fall of SBF, Vox mentions--albeit buried in the form of a parenthetical "Full Disclosure" in the middle of the piece--that they had receieved an undisclosed sum from Bankman-Fried's foundation. (Vox and ProPublica did not respond to requests for comment.)

Semafor, the new publication led by former New York Times media columnist Ben Smith, similarly received an unspecified investment from Bankman-Fried.

Read the whole thing.

We're in a whole new world: the direct payment of "media" for puff pieces by the oligarchy, with hardly any pretense or shame about the transaction whatsoever.

Lee Smith has been writing a long time about the media's evolution into a pure payola play, in which well-heeled interested parties straight-up engage in pay-to-publish schemes -- as was the case with FusionGPS paying reporters for "research" -- but this is the next evolution.

The words "Corporate Press" will take on a whole new meaning, as particular oligarchs sponsor their very own O-and-O (owned-and-operated) "journalists."

David Sacks responded with appropriate revulsion to the New York Times, throwing SBF's admission that he just says "the right shibboleths" so that "everyone likes us."

David Sacks @DavidSacksThe biggest con man since Madoff just admitted that woke is a virtue-signaling game "where we say all the right shibboleths and so everyone likes us." How stupid does the NYT feel now?

How do they feel? They feel fine, Sacks. They feel absolutely fine.

They do not feel ashamed in the least. The media "elite" are in a post-consequences culture. They're post-shame. They're post-accountability.

They're post-Enlightenment.

This is the New Feudalism, and the New Dark Ages.

We will no longer pretend that we are equal in the eyes of the law. We are too sophisticated and wise to pretend like children about that any longer.

The New Aristocracy does not feel shame for doing as their noble blood dictates they do. Blood is thicker than water; their blood decrees that they all stick together, against he baying hordes and unthinking mobs.

Oh in case you haven't heard: Sam Bankman-Fried, the second-biggest donor to the Democrat Party after George Soros, has fled. His current whereabouts are unknown.

Joe Biden hasn't mentioned him.

But Joe Biden is telling his SEC, DOJ, and FBI to find some pretext by which they can harass and possibly prosecute his political enemy Elon Musk.

No word about whether anyone is looking for SBF. Certainly it's not a government priority.

We're in the Dark Ages again. You are either on the side of the King, or you are an Enemy of the King and therefore Outside the Protection of the Law. An Outlaw.

The WEF is the World Economic Forum -- Klaus Schaub's Corporatist/Socialist SPECTRE that insists You Will Eat The Bugs and that You Will Own Nothing and Like It!

No, seriously.

The WEF published this video in 2018, where they state:

— James Melville (@JamesMelville) November 16, 2022

“You will own nothing. And you’ll be happy”.

pic.twitter.com/g18kzC6Ekt

Bonus: Wait, what?

The FTX bankruptcy filing is an incredible document start to finish, but "their accounting firm was in the metaverse" is really a line for the ages. https://t.co/MjUuTZ7JT6 pic.twitter.com/wa0AEjPnsU

— Megan Greenwell (@megreenwell) November 17, 2022

More:

NBC News @NBCNewsThe new CEO and restructuring officer of FTX issued a searing indictment of the company’s operations in a court filing as part of the company’s ongoing bankruptcy process.

"Never in my career have I seen such a complete failure of corporate controls."

How bad are their books?

Oh boy. Let me tell you. Bear in mind, their accounting firm's office is a virtual office on Meta -- that is, it doesn't actually exist in the real world -- so that should start to give you an idea of the Shit Show they're running.

But it might not quite prepare you.

A crooked enterprise run by leftwing Democrats. What you see when you open up FTX's books is... exactly what America's balance sheets look like.

And: Could this be true? Could Kevin McCarthy have used money from an FTX cofounder to defeat MAGA candidate?

It sounds so bad that it must be true.

Cheese and Crepes, This is the Quality of Ass a Billionaire Nails? Per rumor, this is SBF's squeeze. I mean, he's in a "polycule" -- a polyamorous blob of multiple people all cucking each other -- but this is his "girlfriend," supposedly.

Meet Caroline Ellison, CEO of Sam Bankman Fried's Alameda Research and self-described Harry Potter fan. And now you know what happened to FTX.

— Ian Miles Cheong (@stillgray) November 11, 2022

pic.twitter.com/ek9NR1Gp5Z

She's a Build-A-Bear 4, tops.

So this is the generation taking over, huh?

I know it's a cliche at this point, but: We're doomed.

four seasons: " Does anyone give a *hit about the Washington Gen ..."

Hour of the Wolf: "I like the top "joke", but I don't believe it. Whe ..."

Hadrian the Seventh : " *heats up fish in ONT microwave* Good evening ..."

GWB: "I almost spewed my drink when I read the "joke." N ..."

Alteria Pilgram - My President has convictions.: "Open topic: The Washington Generals are greater th ..."

Count de Monet: "When the commentators are ready, the ONT will appe ..."

clarence: "Called the otters. ..."

Count de Monet: "and . . . they're off! ..."

Matthew Kant Cipher: "Happy Monday, MisHum! ..."

Sock Monkey * sporting my Andrew Breitbart attitude : "Mishum in the house! ..."

clarence: "Looks like someone forgot to hit post. "Push th ..."

Washington's Birthday Cafe

Quick Hits

Revealed: The Erotic Poetry of... Eric Swalwell?

The Media Whined That the Washington Post Cancelled Its World-Beating Sports Section.

The Media, You Will Not Be Surprised to Learn, Lied

RFKJr. Reveals Harrowing Evidence About the Extent of California Fraud

Leftists: Replacement Theory is a White Nationalist Conspiracy Theory

Also Leftists: The English Countryside Is Too White So We Have to Move Minorities and Migrants Into It

CNN Pollster: An All-Time High of American Voters, 58%, Say Democrats are "Too Liberal"

Rubio and AOC Offer Competing Visions of Foreign Policy, Realist Vs. Retard

THE MORNING RANT: The SBA Will Stop Lending to Non-Citizens

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Democratic Forays into Erotica

New Shows On Gore's DNC/MTV Network

Nicknames for Potatoes, By People Who Really Hate Potatoes

Star Wars Euphemisms for Self-Abuse

Signs You're at an Iraqi "Wedding Party"

Signs Your Clown Has Gone Bad

Signs That You, Geroge Michael, Should Probably Just Give It Up

Signs of Hip-Hop Influence on John Kerry

NYT Headlines Spinning Bush's Jobs Boom

Things People Are More Likely to Say Than "Did You Hear What Al Franken Said Yesterday?"

Signs that Paul Krugman Has Lost His Frickin' Mind

All-Time Best NBA Players, According to Senator Robert Byrd

Other Bad Things About the Jews, According to the Koran

Signs That David Letterman Just Doesn't Care Anymore

Examples of Bob Kerrey's Insufferable Racial Jackassery

Signs Andy Rooney Is Going Senile

Other Judgments Dick Clarke Made About Condi Rice Based on Her Appearance

Collective Names for Groups of People

John Kerry's Other Vietnam Super-Pets

Cool Things About the XM8 Assault Rifle

Media-Approved Facts About the Democrat Spy

Changes to Make Christianity More "Inclusive"

Secret John Kerry Senatorial Accomplishments

John Edwards Campaign Excuses

John Kerry Pick-Up Lines

Changes Liberal Senator George Michell Will Make at Disney

Torments in Dog-Hell

The Ace of Spades HQ Sex-for-Money Skankathon

A D&D Guide to the Democratic Candidates

Margaret Cho: Just Not Funny

More Margaret Cho Abuse

Margaret Cho: Still Not Funny

Iraqi Prisoner Claims He Was Raped... By Woman

Wonkette Announces "Morning Zoo" Format

John Kerry's "Plan" Causes Surrender of Moqtada al-Sadr's Militia

World Muslim Leaders Apologize for Nick Berg's Beheading

Michael Moore Goes on Lunchtime Manhattan Death-Spree

Milestone: Oliver Willis Posts 400th "Fake News Article" Referencing Britney Spears

Liberal Economists Rue a "New Decade of Greed"

Artificial Insouciance: Maureen Dowd's Word Processor Revolts Against Her Numbing Imbecility

Intelligence Officials Eye Blogs for Tips

They Done Found Us Out, Cletus: Intrepid Internet Detective Figures Out Our Master Plan

Shock: Josh Marshall Almost Mentions Sarin Discovery in Iraq

Leather-Clad Biker Freaks Terrorize Australian Town

When Clinton Was President, Torture Was Cool

What Wonkette Means When She Explains What Tina Brown Means

Wonkette's Stand-Up Act

Wankette HQ Gay-Rumors Du Jour

Here's What's Bugging Me: Goose and Slider

My Own Micah Wright Style Confession of Dishonesty

Outraged "Conservatives" React to the FMA

An On-Line Impression of Dennis Miller Having Sex with a Kodiak Bear

The Story the Rightwing Media Refuses to Report!

Our Lunch with David "Glengarry Glen Ross" Mamet

The House of Love: Paul Krugman

A Michael Moore Mystery (TM)

The Dowd-O-Matic!

Liberal Consistency and Other Myths

Kepler's Laws of Liberal Media Bias

John Kerry-- The Splunge! Candidate

"Divisive" Politics & "Attacks on Patriotism" (very long)

The Donkey ("The Raven" parody)