Intermarkets' Privacy Policy

Donate to Ace of Spades HQ!

aceofspadeshq at gee mail.com

Buck:

buck.throckmorton at protonmail.com

CBD:

cbd at cutjibnewsletter.com

joe mannix:

mannix2024 at proton.me

MisHum:

petmorons at gee mail.com

J.J. Sefton:

sefton at cutjibnewsletter.com

Sunday Overnight Open Thread - March 8, 2026 [Doof]

Gun Thread: March 2/5 Edition!

Food Thread: Quiet, Young Dog!

First World Problems...

Tucker Carlson: Lord Haw Haw With A Bow Tie

Sunday Morning Book Thread - 3-8-2026 ["Perfessor" Squirrel]

Daily Tech News 8 March 2026

Saturday Night Club ONT - March 7, 2026 [2 Ds]

Saturday Evening Movie Thread - 3/7/2026

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

maildrop62 at proton dot me

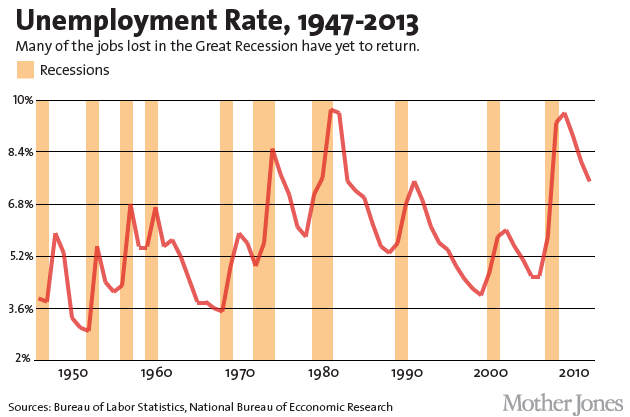

More than Four Years Since The Great Recession Officially (Technically) Ended, The Economy's Still Terrible

The economy supposedly posted growth of 4.1% last quarter. If that's true, why is the economy still so sickly?

While there's little sense that the U.S. economy is headed for another downturn, most forecasters expect further improvement in 2014 will be gradual. Unless and until the job market improves substantially, and higher wages drive a convincing pickup in consumer spending and demand, the lingering damage to confidence will likely keep the weakest economic recovery in memory plodding along at a frustratingly slow pace....

"The economy is continuing to make progress, but it also has much farther to travel before conditions can be judged normal," Federal Reserve Chairman Ben Bernanke told reporters in his final news conference as head of the 100-year-old institution.

...

That sluggish job growth goes a long way to explaining why—for millions of Americans—the Great Recession never ended. While the "official" unemployment rate has fallen steadily since the summer of 2009, the improvement in the data has come largely from the ongoing wave of jobless people who have given up looking for work.

Many of them—like Mary Villalba, 65, of Centennial, Colo.—fear they may never find a job as good as the one they lost to the recession.

Mother Jones (!) punctures the idea that the economy is Just Fine with charts.

Former Obama economic advisor Larry Summers notes that this "recovery" does not resemble prior ones.

Last month I argued that the U.S. and global economies may be in a period of secular stagnation in which sluggish growth and output, and employment levels well below potential, might coincide for some time to come with problematically low real interest rates. Since the start of this century, annual growth in U.S. gross domestic product has averaged less than 1.8 percent. The economy is now operating nearly 10 percent, or more than $1.6 trillion, below what the Congressional Budget Office judged to be its potential path as recently as 2007. And all this is in the face of negative real interest rates for more than five years and extraordinarily easy monetary policies.Even some forecasters who have had the wisdom to remain pessimistic about growth prospects the past few years are coming around to more optimistic views of 2014, at least in the United States. This is encouraging but should be qualified with the recognition that even on optimistic forecasts, output and employment stand to remain well below previous trends for many years. More troubling, even with the high degree of slack in the economy and with wage and price inflation slowing, there are signs of eroding credit standards and inflated asset values. If the United States were to enjoy several years of healthy growth under anything like current credit conditions, there is every reason to expect a return to the kind of problems of bubbles and excess lending seen in 2005 to 2007 long before output and employment returned to normal trend growth or inflation picked up again.

He outlines three responses: Supply side economic policy, Fed easy-money monetary policy, and a progressive demand-side policy. He winds up championing the third. Obama advisor arguing for more Obamanomics, go figure.

But here's what he says about the second strategy, the Fed's helicoptering money into the economy:

...

The second strategy, which has dominated U.S. policy in recent years, is lowering relevant interest rates and capital costs as much as possible and relying on regulatory policies to ensure financial stability. No doubt the economy is far healthier now than it would have been in the absence of these measures. But a growth strategy that relies on interest rates significantly below growth rates for long periods virtually ensures the emergence of substantial financial bubbles and dangerous buildups in leverage. The idea that regulation can allow the growth benefits of easy credit to come without cost is a chimera.

Artificially juicing the economy with money we don't have results in artificially raising prices for things. Thus creating a bubble. And we may be back to creating a second housing bubble. I guess we're creating a second housing bubble because the first one was so awesome.

IN November, housing starts were up 23 percent, and there was cheering all around. But the crowd would quiet down if it realized that another housing bubble had begun to grow.

The writer notes that a bubble can be detected when the rate of growth of prices for buying property greatly exceed the rate of growth of rents that can be charged for that property. After all, the actual income one hopes to generate from property is based on its rental value; if the property's value is going up at double the rate of rents, then that increase in price is due to speculation about the property's future value. And that's the sign of a bubble.

Today, after the financial crisis, the recession and the slow recovery, the bubble is beginning to grow again. Between 2011 and the third quarter of 2013, housing prices grew by 5.83 percent, again exceeding the increase in rental costs, which was 2 percent. ...

Both this bubble and the last one were caused by the government’s housing policies, which made it possible for many people to purchase homes with very little or no money down....

Today, the same forces are operating. The Federal Housing Administration is requiring down payments of just 3.5 percent. Fannie and Freddie are requiring a mere 5 percent. According to the American Enterprise Institute’s National Mortgage Risk Index data set for Oct. 2013, about half of those getting mortgages to buy homes — not to refinance — put 5 percent or less down. When anyone suggests that down payments should be raised to the once traditional 10 or 20 percent, the outcry in Congress and from brokers and homebuilders is deafening.

So here we go again.

By the way: Lawrence Summers referred to "secular stagnation" in the economy. Here's a quick definition from Wikipedia.

During the Great Depression, private capital investment fell because of excess capacity and lack of good investment opportunities. Secular stagnation theory blamed inadequate capital investment for hindering full deployment of labor and other economic resources.

I'm not an economist, but it sure sounds if Larry Summers is right, he should be arguing for methods of increasing capital investment. And that means incentivizing it, or, rather, not disincentivizing it as much as we do presently.

And that means we should do the exact opposite of what Obama is doing, not more of the same.

Thanks to @rdbrewer4 for most of the links in this post.

Braenyard - some Absent Friends are more equal than others _: "Keep your eyes on the road and your hands on the w ..."

Braenyard - some Absent Friends are more equal than others _: "The Monterery lines were not part of the original ..."

Braenyard - some Absent Friends are more equal than others _: "=============== Wot the ell? I'm blocked from v ..."

SciVo: "[i]396 Streets of Laredo youtube.com/watch?v=G ..."

Riverboat Miklos: "Call www.youtube.com/watch?v=FSU145Cr9So Pos ..."

Tarbender: ">>You buy a jar of Folger's Crystals, you put it i ..."

Braenyard - some Absent Friends are more equal than others _: "I'll meet that and you raise one Buck Owens htt ..."

tcn in AK: "365 Bald alien chick, or is it a dude? Yikes. To b ..."

Semi-Literate Thug: " 178 Does Cuba have any rare earths ?? Posted by ..."

Blonde Morticia: " https://tinyurl.com/v9twzwe8 Posted by: Braenya ..."

Tarbender: "Streets of Laredo youtube.com/watch?v=GElKGmwfUFc ..."

Sunday Overnight Open Thread - March 8, 2026 [Doof]

Gun Thread: March 2/5 Edition!

Food Thread: Quiet, Young Dog!

First World Problems...

Tucker Carlson: Lord Haw Haw With A Bow Tie

Sunday Morning Book Thread - 3-8-2026 ["Perfessor" Squirrel]

Daily Tech News 8 March 2026

Saturday Night Club ONT - March 7, 2026 [2 Ds]

Saturday Evening Movie Thread - 3/7/2026

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Democratic Forays into Erotica

New Shows On Gore's DNC/MTV Network

Nicknames for Potatoes, By People Who Really Hate Potatoes

Star Wars Euphemisms for Self-Abuse

Signs You're at an Iraqi "Wedding Party"

Signs Your Clown Has Gone Bad

Signs That You, Geroge Michael, Should Probably Just Give It Up

Signs of Hip-Hop Influence on John Kerry

NYT Headlines Spinning Bush's Jobs Boom

Things People Are More Likely to Say Than "Did You Hear What Al Franken Said Yesterday?"

Signs that Paul Krugman Has Lost His Frickin' Mind

All-Time Best NBA Players, According to Senator Robert Byrd

Other Bad Things About the Jews, According to the Koran

Signs That David Letterman Just Doesn't Care Anymore

Examples of Bob Kerrey's Insufferable Racial Jackassery

Signs Andy Rooney Is Going Senile

Other Judgments Dick Clarke Made About Condi Rice Based on Her Appearance

Collective Names for Groups of People

John Kerry's Other Vietnam Super-Pets

Cool Things About the XM8 Assault Rifle

Media-Approved Facts About the Democrat Spy

Changes to Make Christianity More "Inclusive"

Secret John Kerry Senatorial Accomplishments

John Edwards Campaign Excuses

John Kerry Pick-Up Lines

Changes Liberal Senator George Michell Will Make at Disney

Torments in Dog-Hell

The Ace of Spades HQ Sex-for-Money Skankathon

A D&D Guide to the Democratic Candidates

Margaret Cho: Just Not Funny

More Margaret Cho Abuse

Margaret Cho: Still Not Funny

Iraqi Prisoner Claims He Was Raped... By Woman

Wonkette Announces "Morning Zoo" Format

John Kerry's "Plan" Causes Surrender of Moqtada al-Sadr's Militia

World Muslim Leaders Apologize for Nick Berg's Beheading

Michael Moore Goes on Lunchtime Manhattan Death-Spree

Milestone: Oliver Willis Posts 400th "Fake News Article" Referencing Britney Spears

Liberal Economists Rue a "New Decade of Greed"

Artificial Insouciance: Maureen Dowd's Word Processor Revolts Against Her Numbing Imbecility

Intelligence Officials Eye Blogs for Tips

They Done Found Us Out, Cletus: Intrepid Internet Detective Figures Out Our Master Plan

Shock: Josh Marshall Almost Mentions Sarin Discovery in Iraq

Leather-Clad Biker Freaks Terrorize Australian Town

When Clinton Was President, Torture Was Cool

What Wonkette Means When She Explains What Tina Brown Means

Wonkette's Stand-Up Act

Wankette HQ Gay-Rumors Du Jour

Here's What's Bugging Me: Goose and Slider

My Own Micah Wright Style Confession of Dishonesty

Outraged "Conservatives" React to the FMA

An On-Line Impression of Dennis Miller Having Sex with a Kodiak Bear

The Story the Rightwing Media Refuses to Report!

Our Lunch with David "Glengarry Glen Ross" Mamet

The House of Love: Paul Krugman

A Michael Moore Mystery (TM)

The Dowd-O-Matic!

Liberal Consistency and Other Myths

Kepler's Laws of Liberal Media Bias

John Kerry-- The Splunge! Candidate

"Divisive" Politics & "Attacks on Patriotism" (very long)

The Donkey ("The Raven" parody)