Intermarkets' Privacy Policy

Support

Donate to Ace of Spades HQ!

Contact

Ace:aceofspadeshq at gee mail.com

Buck:

buck.throckmorton at protonmail.com

CBD:

cbd at cutjibnewsletter.com

joe mannix:

mannix2024 at proton.me

MisHum:

petmorons at gee mail.com

J.J. Sefton:

sefton at cutjibnewsletter.com

Recent Entries

Friday Cafe

The Week in Woke

Open Thread: It Took Three Years and Ton of Money, But Fireball Tools Turned Their Offices Into a Sci-Fi Starship Interior Out of Star Wars and Star Trek

War Powers Act Vote to Limit Iran Action Fails, Meaning This Is Now a Congressionally Approved War

Candace Owens to Military-Aged Men: Trump Has Betrayed You, Do Not Join or Remain in the Military, Abandon Your Posts and Take Dishonorable Discharges

"Prohibited Access:" Kash Patel Now Examining the FBI's Dark Files, the Hidden History of the Deep State

Oh No! GOP Lawmakers Push for Perjury Charges Against Madison Cornbread for Fabricated J6 Testimony

THE MORNING RANT: Some Other Election News Out of Texas; plus, A Great Summary from Real Clear Investigations of the EV Debacle’s Cost

Mid-Morning Art Thread

The Morning Report — 3/6/26

The Week in Woke

Open Thread: It Took Three Years and Ton of Money, But Fireball Tools Turned Their Offices Into a Sci-Fi Starship Interior Out of Star Wars and Star Trek

War Powers Act Vote to Limit Iran Action Fails, Meaning This Is Now a Congressionally Approved War

Candace Owens to Military-Aged Men: Trump Has Betrayed You, Do Not Join or Remain in the Military, Abandon Your Posts and Take Dishonorable Discharges

"Prohibited Access:" Kash Patel Now Examining the FBI's Dark Files, the Hidden History of the Deep State

Oh No! GOP Lawmakers Push for Perjury Charges Against Madison Cornbread for Fabricated J6 Testimony

THE MORNING RANT: Some Other Election News Out of Texas; plus, A Great Summary from Real Clear Investigations of the EV Debacle’s Cost

Mid-Morning Art Thread

The Morning Report — 3/6/26

Absent Friends

Jay Guevara 2025

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

AoSHQ Writers Group

A site for members of the Horde to post their stories seeking beta readers, editing help, brainstorming, and story ideas. Also to share links to potential publishing outlets, writing help sites, and videos posting tips to get published.

Contact OrangeEnt for info:

maildrop62 at proton dot me

maildrop62 at proton dot me

Cutting The Cord And Email Security

Moron Meet-Ups

« Mid-Morning Art Thread |

Main

| Don Lemon: It's Time to Finally Declare Which Race Is Committing All the Violence In America »

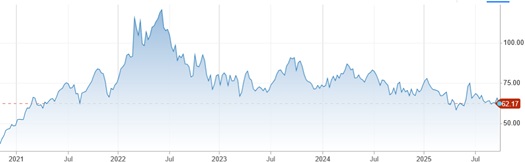

[Five Year Price Chart of West Texas Intermediate]

The price of crude oil has dropped about 10% since the 2024 presidential election. And domestic production is expected to reach 13.41-million-barrels/day in 2025...a record!

September 30, 2025

The Morning Rant: Minimalist Edition

The cost of energy is an integral part of our economic outlook, and because of rising domestic production, which decreases inflationary pressure, energy's impact on inflation is moderating. Couple that with increased employment in the industry, increased tax receipts for government, and domestic energy production is an unalloyed good thing. Environmental impacts from production are minimal and manageable, and modern IC engines and power plants are incredibly clean.

According to the Department of Energy, petroleum contributes about 8% to our GDP, which is a lot, but not catastrophic in the event of a downturn. Compare that to Russia, whose petroleum industry contributes about 20% and provides a huge chunk of their foreign exchange. So a decrease in oil prices has a far more significant effect on Russia than it does on the United States. Oil is Russia's lifeblood! If prices fall, they must pump more oil to maintain their spending on many things, including their little adventure in eastern Ukraine.

Oil falls as OPEC+ plan adds to expectations of supply surplus

In a meeting scheduled for Sunday, the Organization of the Petroleum Exporting Countries and allies including Russia, together known as OPEC+, will likely approve another oil production increase of at least 137,000 barrels per day, three sources familiar with the talks said.Goldman Sachs on Tuesday said that it expects OPEC+ to raise oil production quotas by 140,000 barrels per day for November.

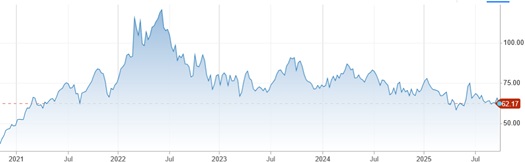

[Five Year Price Chart of West Texas Intermediate]

The price of crude oil has dropped about 10% since the 2024 presidential election. And domestic production is expected to reach 13.41-million-barrels/day in 2025...a record!

So why is that important? Because we can supply a huge amount of our domestic usage, while still exporting 10 million barrels/day. That decrease in oil price helps us domestically far more than it damages our export revenue. Contrast that with Russia, which depends far more on that export revenue. Sadly, a decrease in oil prices helps net importers...like China! But the more immediate impact on Russia's financial health might be more important. Will it pressure Putin to accelerate his Ukraine sojourn? Or maybe it will provide the impetus for some sort of negotiated ceasefire or peace treaty. Or maybe he will simply pump more oil and try to make up the difference.

I doubt Russia pays attention to the OPEC+ production restrictions anyway. Putin will pump what he needs to sell, regardless! But that is a nasty little feedback loop. Pump more, drive prices down, so he needs to pump even more! All the while his petroleum infrastructure is decaying, and he can't buy a lot of equipment because of sanctions!

By the way, Qatar exports most of their petroleum, so they are quite vulnerable to price decreases. It would be a shame if the Emir of Qatar would have to cut back on his funding of Hamas, Islamist programs at American universities, Tucker Carlson, and Al Jazeera!

[Crossposted at CutJibNewsletter and X/Twitter]. If you folks who are on X/Twitter would follow us it would be much appreciated!

Recent Comments

Ben Had:

"Top picture. Takes a lot to be butt ugly in two a ..."

ShainS -- Algorithmic Racist, Semantic Ablationist, and Systematic Lobotomist [/b][/i][/s][/u]: "Imagine walking into your kids’ classroom an ..."

Semi-Literate Thug: " Former space force colonel. Well, "former" for a ..."

Braenyard - some Absent Friends are more equal than others _: "When do we get the Reconquista? Posted by: Cow De ..."

Going deep. Out. : "Re Omar: F Minnesota and all who sail in her. ..."

Kindltot: "I got my little tom-cat back from the vets for a n ..."

L - No nic, another fine day: "The gentleman wearing the red tie, vote for him. H ..."

NaCly Dog: "{{{TeumsehTea}}} Been praying for your health. ..."

Axeman: "I don't think "Penny Wagonwheel" has much of a fut ..."

Ernst Roehm: "First pet name and the first street you lived on = ..."

rickb223 [/b][/s][/u][/i]: "For all those who said Bondi was anti 2A, the DOJ ..."

RedMindBlueState[/i][/b][/s][/u]: ""In the Garden of Beasts," Erik Larsen. Very illum ..."

ShainS -- Algorithmic Racist, Semantic Ablationist, and Systematic Lobotomist [/b][/i][/s][/u]: "Imagine walking into your kids’ classroom an ..."

Semi-Literate Thug: " Former space force colonel. Well, "former" for a ..."

Braenyard - some Absent Friends are more equal than others _: "When do we get the Reconquista? Posted by: Cow De ..."

Going deep. Out. : "Re Omar: F Minnesota and all who sail in her. ..."

Kindltot: "I got my little tom-cat back from the vets for a n ..."

L - No nic, another fine day: "The gentleman wearing the red tie, vote for him. H ..."

NaCly Dog: "{{{TeumsehTea}}} Been praying for your health. ..."

Axeman: "I don't think "Penny Wagonwheel" has much of a fut ..."

Ernst Roehm: "First pet name and the first street you lived on = ..."

rickb223 [/b][/s][/u][/i]: "For all those who said Bondi was anti 2A, the DOJ ..."

RedMindBlueState[/i][/b][/s][/u]: ""In the Garden of Beasts," Erik Larsen. Very illum ..."

Recent Entries

Friday Cafe

The Week in Woke

Open Thread: It Took Three Years and Ton of Money, But Fireball Tools Turned Their Offices Into a Sci-Fi Starship Interior Out of Star Wars and Star Trek

War Powers Act Vote to Limit Iran Action Fails, Meaning This Is Now a Congressionally Approved War

Candace Owens to Military-Aged Men: Trump Has Betrayed You, Do Not Join or Remain in the Military, Abandon Your Posts and Take Dishonorable Discharges

"Prohibited Access:" Kash Patel Now Examining the FBI's Dark Files, the Hidden History of the Deep State

Oh No! GOP Lawmakers Push for Perjury Charges Against Madison Cornbread for Fabricated J6 Testimony

THE MORNING RANT: Some Other Election News Out of Texas; plus, A Great Summary from Real Clear Investigations of the EV Debacle’s Cost

Mid-Morning Art Thread

The Morning Report — 3/6/26

The Week in Woke

Open Thread: It Took Three Years and Ton of Money, But Fireball Tools Turned Their Offices Into a Sci-Fi Starship Interior Out of Star Wars and Star Trek

War Powers Act Vote to Limit Iran Action Fails, Meaning This Is Now a Congressionally Approved War

Candace Owens to Military-Aged Men: Trump Has Betrayed You, Do Not Join or Remain in the Military, Abandon Your Posts and Take Dishonorable Discharges

"Prohibited Access:" Kash Patel Now Examining the FBI's Dark Files, the Hidden History of the Deep State

Oh No! GOP Lawmakers Push for Perjury Charges Against Madison Cornbread for Fabricated J6 Testimony

THE MORNING RANT: Some Other Election News Out of Texas; plus, A Great Summary from Real Clear Investigations of the EV Debacle’s Cost

Mid-Morning Art Thread

The Morning Report — 3/6/26

Search

Polls! Polls! Polls!

Frequently Asked Questions

The (Almost) Complete Paul Anka Integrity Kick

Primary Document: The Audio

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Top Top Tens

Democratic Forays into Erotica

New Shows On Gore's DNC/MTV Network

Nicknames for Potatoes, By People Who Really Hate Potatoes

Star Wars Euphemisms for Self-Abuse

Signs You're at an Iraqi "Wedding Party"

Signs Your Clown Has Gone Bad

Signs That You, Geroge Michael, Should Probably Just Give It Up

Signs of Hip-Hop Influence on John Kerry

NYT Headlines Spinning Bush's Jobs Boom

Things People Are More Likely to Say Than "Did You Hear What Al Franken Said Yesterday?"

Signs that Paul Krugman Has Lost His Frickin' Mind

All-Time Best NBA Players, According to Senator Robert Byrd

Other Bad Things About the Jews, According to the Koran

Signs That David Letterman Just Doesn't Care Anymore

Examples of Bob Kerrey's Insufferable Racial Jackassery

Signs Andy Rooney Is Going Senile

Other Judgments Dick Clarke Made About Condi Rice Based on Her Appearance

Collective Names for Groups of People

John Kerry's Other Vietnam Super-Pets

Cool Things About the XM8 Assault Rifle

Media-Approved Facts About the Democrat Spy

Changes to Make Christianity More "Inclusive"

Secret John Kerry Senatorial Accomplishments

John Edwards Campaign Excuses

John Kerry Pick-Up Lines

Changes Liberal Senator George Michell Will Make at Disney

Torments in Dog-Hell

Greatest Hitjobs

The Ace of Spades HQ Sex-for-Money Skankathon

A D&D Guide to the Democratic Candidates

Margaret Cho: Just Not Funny

More Margaret Cho Abuse

Margaret Cho: Still Not Funny

Iraqi Prisoner Claims He Was Raped... By Woman

Wonkette Announces "Morning Zoo" Format

John Kerry's "Plan" Causes Surrender of Moqtada al-Sadr's Militia

World Muslim Leaders Apologize for Nick Berg's Beheading

Michael Moore Goes on Lunchtime Manhattan Death-Spree

Milestone: Oliver Willis Posts 400th "Fake News Article" Referencing Britney Spears

Liberal Economists Rue a "New Decade of Greed"

Artificial Insouciance: Maureen Dowd's Word Processor Revolts Against Her Numbing Imbecility

Intelligence Officials Eye Blogs for Tips

They Done Found Us Out, Cletus: Intrepid Internet Detective Figures Out Our Master Plan

Shock: Josh Marshall Almost Mentions Sarin Discovery in Iraq

Leather-Clad Biker Freaks Terrorize Australian Town

When Clinton Was President, Torture Was Cool

What Wonkette Means When She Explains What Tina Brown Means

Wonkette's Stand-Up Act

Wankette HQ Gay-Rumors Du Jour

Here's What's Bugging Me: Goose and Slider

My Own Micah Wright Style Confession of Dishonesty

Outraged "Conservatives" React to the FMA

An On-Line Impression of Dennis Miller Having Sex with a Kodiak Bear

The Story the Rightwing Media Refuses to Report!

Our Lunch with David "Glengarry Glen Ross" Mamet

The House of Love: Paul Krugman

A Michael Moore Mystery (TM)

The Dowd-O-Matic!

Liberal Consistency and Other Myths

Kepler's Laws of Liberal Media Bias

John Kerry-- The Splunge! Candidate

"Divisive" Politics & "Attacks on Patriotism" (very long)

The Donkey ("The Raven" parody)