Intermarkets' Privacy Policy

Support

Donate to Ace of Spades HQ!

Contact

Ace:aceofspadeshq at gee mail.com

Buck:

buck.throckmorton at protonmail.com

CBD:

cbd at cutjibnewsletter.com

joe mannix:

mannix2024 at proton.me

MisHum:

petmorons at gee mail.com

J.J. Sefton:

sefton at cutjibnewsletter.com

Recent Entries

Daily Tech News 20 February 2026

Thursday Overnight Open Thread - February 19, 2026 [Doof]

Golden Hour Cafe

BREAKING: DEMOCRAT TERRORISTS CRASH STOLEN AMBULANCE LOADED WITH GAS CANS INTO AN IDAHO FEDERAL BUILDING

Quick Hits

The Demonic Drunkard Tucker Carlson Spins His Most Brazen Lie Yet, Claiming He Was "Detained" by Evil Jews in Israel

The Atlantic Publishe a Viral "Report" Account of a Boy Dying of Measles Because His Parents Didn't Vaccinate Him.

One Small Problem: The "Report" Is Actually Fiction, a "Hypothetical" Morality Play But That Atlantic Presented It As Actual Truth.

11 Arrested in Antifa Lynching Murder of Young Man Protecting Women from Muslim Thugs;

One of the Killers is Legislative Aide to Far-Left Member of French Assembly

One of Epstein's Recruiters Decided to Inform On Him to the Police, and Epstein Schemed to Give Him a $3 Million Bribe to Keep Quiet;

He Discussed the Plan with Obama WH Counsel and Friend of Jeff Kathyrine Ruemmler

LOL: Anderson Pooper's Team Rushes to the Media to Claim He Wasn't Pushed Out, He Quit on Prinzibuhls

Thursday Overnight Open Thread - February 19, 2026 [Doof]

Golden Hour Cafe

BREAKING: DEMOCRAT TERRORISTS CRASH STOLEN AMBULANCE LOADED WITH GAS CANS INTO AN IDAHO FEDERAL BUILDING

Quick Hits

The Demonic Drunkard Tucker Carlson Spins His Most Brazen Lie Yet, Claiming He Was "Detained" by Evil Jews in Israel

The Atlantic Publishe a Viral "Report" Account of a Boy Dying of Measles Because His Parents Didn't Vaccinate Him.

One Small Problem: The "Report" Is Actually Fiction, a "Hypothetical" Morality Play But That Atlantic Presented It As Actual Truth.

11 Arrested in Antifa Lynching Murder of Young Man Protecting Women from Muslim Thugs;

One of the Killers is Legislative Aide to Far-Left Member of French Assembly

One of Epstein's Recruiters Decided to Inform On Him to the Police, and Epstein Schemed to Give Him a $3 Million Bribe to Keep Quiet;

He Discussed the Plan with Obama WH Counsel and Friend of Jeff Kathyrine Ruemmler

LOL: Anderson Pooper's Team Rushes to the Media to Claim He Wasn't Pushed Out, He Quit on Prinzibuhls

Absent Friends

Jay Guevara 2025

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

AoSHQ Writers Group

A site for members of the Horde to post their stories seeking beta readers, editing help, brainstorming, and story ideas. Also to share links to potential publishing outlets, writing help sites, and videos posting tips to get published.

Contact OrangeEnt for info:

maildrop62 at proton dot me

maildrop62 at proton dot me

Cutting The Cord And Email Security

Moron Meet-Ups

« My 1,900 Word Review of "Skyfall" |

Main

| Top Headline Comments 11-14-12 »

November 13, 2012

Overnight Open Thread (11-13-2012)

Q: Does Obamacare Impose a 3.8 Percent "Sales Tax" on Your Home?

Well contra the article linked the answer is Yes. The only good news is that most people won't be hit with it...for now.

We've been flooded with queries about this one ever since the health care bill became law. At the last minute, Democratic lawmakers decided on a new 3.8 percent tax on the net investment income of high-income persons. But the claim that this would amount to a $15,200 tax on the sale of a typical $400,000 home is utterly false.

The truth is that only a tiny percentage of home sellers will pay the tax. First of all, only those with incomes over $200,000 a year ($250,000 for married couples filing jointly) will be subject to it. And even for those who have such high incomes, the tax still won't apply to the first $250,000 on profits from the sale of a personal residence - or to the first $500,000 in the case of a married couple selling their home.

But if you own vacation or investment property though, look out:

The Internal Revenue Service says that to qualify for the $250,000/$500,000 exclusion, a seller must have owned the home and lived there as the seller's "main home" for at least two years out of the five years prior to the sale.

Obamacare just gets better and better doesn't it.

So Occupy Wall Street has moved on and is now buying and forgiving personal debt as part of Rolling Jubilee:

OWS is going to start buying distressed debt (medical bills, student loans, etc.) in order to forgive it. As a test run, we spent $500, which bought $14,000 of distressed debt. We then ERASED THAT DEBT. (If you're a debt broker, once you own someone's debt you can do whatever you want with it - traditionally, you hound debtors to their grave trying to collect. We're playing a different game. A MORE AWESOME GAME.)

This is a simple, powerful way to help folks in need -- to free them from heavy debt loads so they can focus on being productive, happy and healthy. As you can see from our test run, the return on investment approaches 30:1. That's a crazy bargain!

Well it's their money and they're free to give it away this way if they want. This may help some people but I suspect OWS will eventually learn what a moral hazard is and/or run out of money.

The 10 Most Obvious Oscar-Bait Film Tropes

The Magical Negro and the Semi-Retard are just two of the most well-known ones.

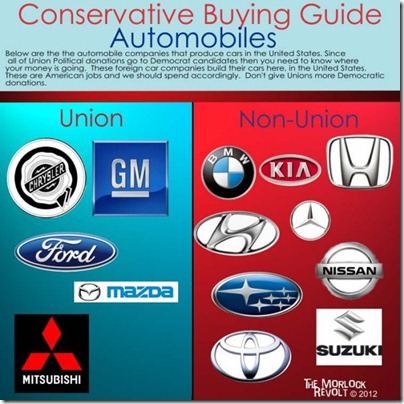

A Conservative's Buying Guide to Automobiles

Well I've been very happy with my Jeep but when I eventually replace it I'm going foreign.

Also meet our new TSA Union overlords.

I remember at TSA's founding when they swore that the it would never be unionized. Well they lied like mother-fucking liars.

The Young Ones: Hands up, Who Likes Me?

Now you can relive that daily anticipation towards Christmas grown-up -style.

It's a Wonderful Life (Hippie Edition)

Teh Tweet!

Tonight's post brought to you by Mae:

Notice: Posted by permission of AceCorp LLC. Please e-mail overnight open thread tips to maetenloch at gmail. Otherwise send tips to Ace.

Recent Comments

Puddleglum at work:

"[i]New legislation introduced in California would ..."

Print THIS!: "Common sense large nylon spool capacity magazine b ..."

m: ">>>The US government is building a specifically VP ..."

m: "w00t ..."

Puddleglum at work: "Mornin' ..."

m: "Pixy's up! ..."

Skip: "TECH THREAD IS NOOD ..."

Skip: "I could nood myself I guess ..."

Tuna: "Morning all ..."

Skip: "G'Day everyone TGIF ..."

Skip: "Oh look! Its time to get up. Waiting on coffee ..."

Skip: "At least its Friday ..."

Print THIS!: "Common sense large nylon spool capacity magazine b ..."

m: ">>>The US government is building a specifically VP ..."

m: "w00t ..."

Puddleglum at work: "Mornin' ..."

m: "Pixy's up! ..."

Skip: "TECH THREAD IS NOOD ..."

Skip: "I could nood myself I guess ..."

Tuna: "Morning all ..."

Skip: "G'Day everyone TGIF ..."

Skip: "Oh look! Its time to get up. Waiting on coffee ..."

Skip: "At least its Friday ..."

Recent Entries

Daily Tech News 20 February 2026

Thursday Overnight Open Thread - February 19, 2026 [Doof]

Golden Hour Cafe

BREAKING: DEMOCRAT TERRORISTS CRASH STOLEN AMBULANCE LOADED WITH GAS CANS INTO AN IDAHO FEDERAL BUILDING

Quick Hits

The Demonic Drunkard Tucker Carlson Spins His Most Brazen Lie Yet, Claiming He Was "Detained" by Evil Jews in Israel

The Atlantic Publishe a Viral "Report" Account of a Boy Dying of Measles Because His Parents Didn't Vaccinate Him.

One Small Problem: The "Report" Is Actually Fiction, a "Hypothetical" Morality Play But That Atlantic Presented It As Actual Truth.

11 Arrested in Antifa Lynching Murder of Young Man Protecting Women from Muslim Thugs;

One of the Killers is Legislative Aide to Far-Left Member of French Assembly

One of Epstein's Recruiters Decided to Inform On Him to the Police, and Epstein Schemed to Give Him a $3 Million Bribe to Keep Quiet;

He Discussed the Plan with Obama WH Counsel and Friend of Jeff Kathyrine Ruemmler

LOL: Anderson Pooper's Team Rushes to the Media to Claim He Wasn't Pushed Out, He Quit on Prinzibuhls

Thursday Overnight Open Thread - February 19, 2026 [Doof]

Golden Hour Cafe

BREAKING: DEMOCRAT TERRORISTS CRASH STOLEN AMBULANCE LOADED WITH GAS CANS INTO AN IDAHO FEDERAL BUILDING

Quick Hits

The Demonic Drunkard Tucker Carlson Spins His Most Brazen Lie Yet, Claiming He Was "Detained" by Evil Jews in Israel

The Atlantic Publishe a Viral "Report" Account of a Boy Dying of Measles Because His Parents Didn't Vaccinate Him.

One Small Problem: The "Report" Is Actually Fiction, a "Hypothetical" Morality Play But That Atlantic Presented It As Actual Truth.

11 Arrested in Antifa Lynching Murder of Young Man Protecting Women from Muslim Thugs;

One of the Killers is Legislative Aide to Far-Left Member of French Assembly

One of Epstein's Recruiters Decided to Inform On Him to the Police, and Epstein Schemed to Give Him a $3 Million Bribe to Keep Quiet;

He Discussed the Plan with Obama WH Counsel and Friend of Jeff Kathyrine Ruemmler

LOL: Anderson Pooper's Team Rushes to the Media to Claim He Wasn't Pushed Out, He Quit on Prinzibuhls

Search

Polls! Polls! Polls!

Frequently Asked Questions

The (Almost) Complete Paul Anka Integrity Kick

Primary Document: The Audio

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Top Top Tens

Democratic Forays into Erotica

New Shows On Gore's DNC/MTV Network

Nicknames for Potatoes, By People Who Really Hate Potatoes

Star Wars Euphemisms for Self-Abuse

Signs You're at an Iraqi "Wedding Party"

Signs Your Clown Has Gone Bad

Signs That You, Geroge Michael, Should Probably Just Give It Up

Signs of Hip-Hop Influence on John Kerry

NYT Headlines Spinning Bush's Jobs Boom

Things People Are More Likely to Say Than "Did You Hear What Al Franken Said Yesterday?"

Signs that Paul Krugman Has Lost His Frickin' Mind

All-Time Best NBA Players, According to Senator Robert Byrd

Other Bad Things About the Jews, According to the Koran

Signs That David Letterman Just Doesn't Care Anymore

Examples of Bob Kerrey's Insufferable Racial Jackassery

Signs Andy Rooney Is Going Senile

Other Judgments Dick Clarke Made About Condi Rice Based on Her Appearance

Collective Names for Groups of People

John Kerry's Other Vietnam Super-Pets

Cool Things About the XM8 Assault Rifle

Media-Approved Facts About the Democrat Spy

Changes to Make Christianity More "Inclusive"

Secret John Kerry Senatorial Accomplishments

John Edwards Campaign Excuses

John Kerry Pick-Up Lines

Changes Liberal Senator George Michell Will Make at Disney

Torments in Dog-Hell

Greatest Hitjobs

The Ace of Spades HQ Sex-for-Money Skankathon

A D&D Guide to the Democratic Candidates

Margaret Cho: Just Not Funny

More Margaret Cho Abuse

Margaret Cho: Still Not Funny

Iraqi Prisoner Claims He Was Raped... By Woman

Wonkette Announces "Morning Zoo" Format

John Kerry's "Plan" Causes Surrender of Moqtada al-Sadr's Militia

World Muslim Leaders Apologize for Nick Berg's Beheading

Michael Moore Goes on Lunchtime Manhattan Death-Spree

Milestone: Oliver Willis Posts 400th "Fake News Article" Referencing Britney Spears

Liberal Economists Rue a "New Decade of Greed"

Artificial Insouciance: Maureen Dowd's Word Processor Revolts Against Her Numbing Imbecility

Intelligence Officials Eye Blogs for Tips

They Done Found Us Out, Cletus: Intrepid Internet Detective Figures Out Our Master Plan

Shock: Josh Marshall Almost Mentions Sarin Discovery in Iraq

Leather-Clad Biker Freaks Terrorize Australian Town

When Clinton Was President, Torture Was Cool

What Wonkette Means When She Explains What Tina Brown Means

Wonkette's Stand-Up Act

Wankette HQ Gay-Rumors Du Jour

Here's What's Bugging Me: Goose and Slider

My Own Micah Wright Style Confession of Dishonesty

Outraged "Conservatives" React to the FMA

An On-Line Impression of Dennis Miller Having Sex with a Kodiak Bear

The Story the Rightwing Media Refuses to Report!

Our Lunch with David "Glengarry Glen Ross" Mamet

The House of Love: Paul Krugman

A Michael Moore Mystery (TM)

The Dowd-O-Matic!

Liberal Consistency and Other Myths

Kepler's Laws of Liberal Media Bias

John Kerry-- The Splunge! Candidate

"Divisive" Politics & "Attacks on Patriotism" (very long)

The Donkey ("The Raven" parody)