Intermarkets' Privacy Policy

Support

Donate to Ace of Spades HQ!

Contact

Ace:aceofspadeshq at gee mail.com

Buck:

buck.throckmorton at protonmail.com

CBD:

cbd at cutjibnewsletter.com

joe mannix:

mannix2024 at proton.me

MisHum:

petmorons at gee mail.com

J.J. Sefton:

sefton at cutjibnewsletter.com

Recent Entries

The Morning Report — 2/19/26

Daily Tech News 19 February 2026

Wednesday Overnight Open Thread - February 18, 2026 [TRex]

Handicapable Hounds Cafe

Quick Hits

As the Communist Cuban Junta Enters End-of-Life Care, Marco Rubio Begins Secretly Talking to Raul Castro's Grandson About a Living Will

Surprise! Harvard Refuses to Obey the Supreme Court Ruling Outlawing Race Discrimination in Admissions. All They've Done Is End Discrimination Against Asians -- and Doubling Up on Anti-White Discrimination

It Begins: Canada Now Murdering People For Minor Ailments, Just As Predicted

Democrat Snake Ted Lieu: The Epstein Files, Which Are Filled with Disproven False Tips About Everyone, Show That Trump was Raping Children

Democrats Demand Censure for Congressman Randy Fine Due to His Protection of Dogs From Arrogant Foreign Colonizers

Daily Tech News 19 February 2026

Wednesday Overnight Open Thread - February 18, 2026 [TRex]

Handicapable Hounds Cafe

Quick Hits

As the Communist Cuban Junta Enters End-of-Life Care, Marco Rubio Begins Secretly Talking to Raul Castro's Grandson About a Living Will

Surprise! Harvard Refuses to Obey the Supreme Court Ruling Outlawing Race Discrimination in Admissions. All They've Done Is End Discrimination Against Asians -- and Doubling Up on Anti-White Discrimination

It Begins: Canada Now Murdering People For Minor Ailments, Just As Predicted

Democrat Snake Ted Lieu: The Epstein Files, Which Are Filled with Disproven False Tips About Everyone, Show That Trump was Raping Children

Democrats Demand Censure for Congressman Randy Fine Due to His Protection of Dogs From Arrogant Foreign Colonizers

Absent Friends

Jay Guevara 2025

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

AoSHQ Writers Group

A site for members of the Horde to post their stories seeking beta readers, editing help, brainstorming, and story ideas. Also to share links to potential publishing outlets, writing help sites, and videos posting tips to get published.

Contact OrangeEnt for info:

maildrop62 at proton dot me

maildrop62 at proton dot me

Cutting The Cord And Email Security

Moron Meet-Ups

ę Shock: Astroturfed "Threat" Left at Patterico |

Main

| Actual Time Magazine Headline: "One-Note Mitt: Is Romney Too Focused On The Economy?" Ľ

June 26, 2012

S&P: Now a 20% Chance of Double-Dip

Only 20%? They say they still stick to their prediction that a slow, weak recovery is the most likely scenario.

Meanwhile, at Gallup and Rasmussen, consumer confidence falls.

Let me admit to my own cocooning: I was surprised when I saw those graphs that the consumer confidence numbers were as high as they were. Still in negative territory, but not nearly as negative as they'd been in 2011. And, until recently, you can see the trendline marching upwards, if slowly.

That's a good example of me blinding myself to contrary data points. I have been frustrated in my failure to understand why Obama's approval ratings were as high as they were; well, part of that frustration is self-inflicted. I didn't buy the "recovery" meme, but I also blinded myself to the fact that most of the country seemed to buy it. At least, they bought it some.

On the other hand, my cocooning is at least not unique. Analysts and media keep having to note "unexpected" drops in hiring and growth because they never seemed to take into account the significant downside risks in this false recovery, either.

I'll try to keep that in mind -- about cocooning myself -- but, honestly, I'll probably forget before the next post.

And all that said -- public opinion and actual economic data seem to be falling to the level of my cocoon.

BTW: Britain's been in a double-dip since the beginning of the year. Europe as a whole is as well.

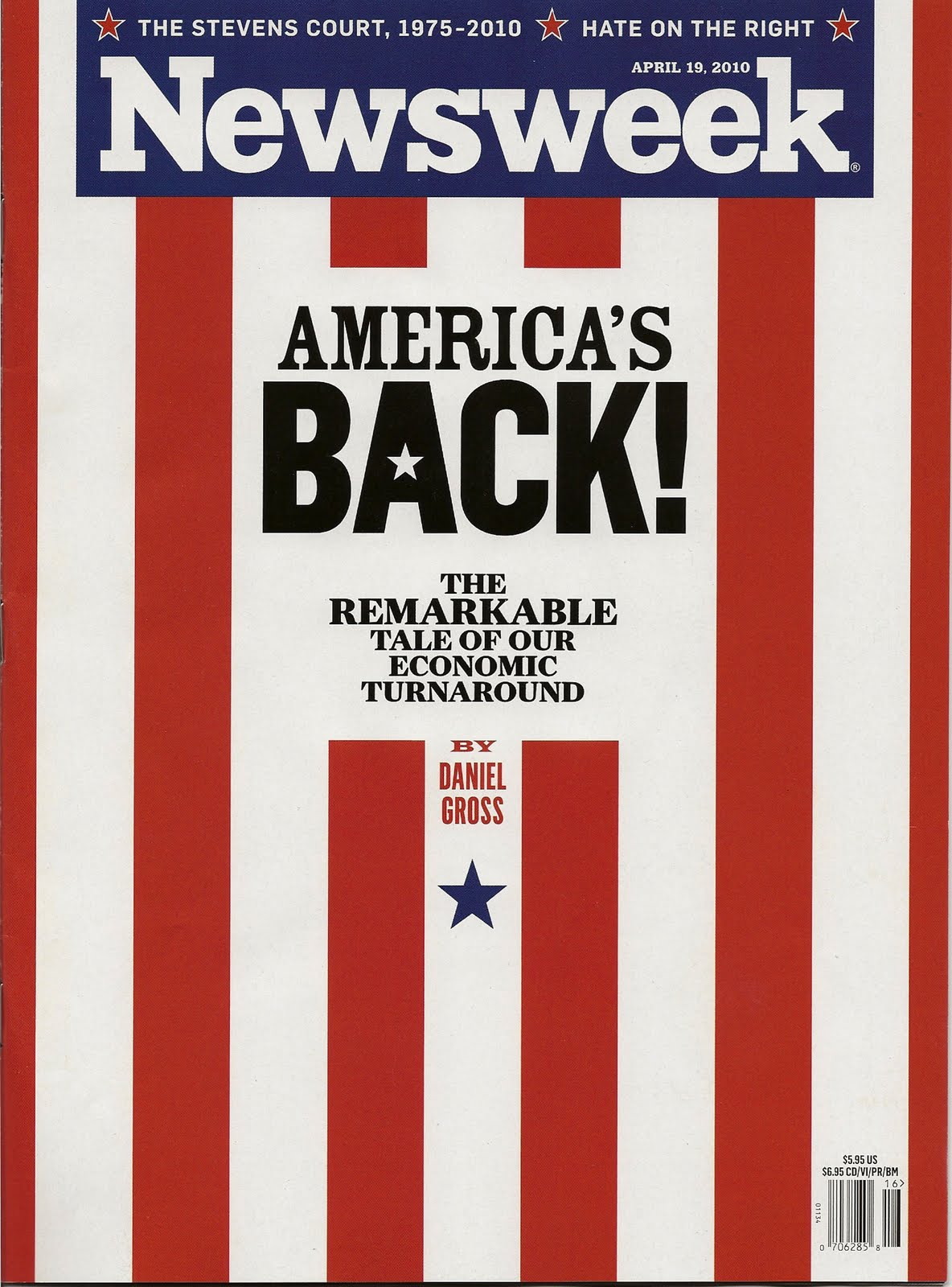

Flashback:

And... Well, people are catching up to me, anyway. Charlie Cook says this is going to be a hard election for Obama to win.

Itís also pretty clear that, despite a ray of sunshine earlier this year, the economy isnít looking as bright today as it did in February and March. The global economic picture is depressing, with even the previously shining lights such as China, India, and Brazil experiencing slowdowns. The eurozone is in a recession that looks more deep than mild, and its sovereign-debt and banking crises are getting worse, not better. Domestically, there is cause for far more concern than would have been warranted at the beginning of this year. While the painful deleveraging process always dictated a slow recovery, economists are scrambling to revise their forecasts of economic growth to reflect the downward trend. The most frequently quoted number for gross domestic product is now 2 percent growth. Not that long ago, some forecasts had approached 3 percent. Unemployment is not expected to improve between now and the election. No incumbent wants to see an unemployment rate at 8 percent or higher. Franklin D. Roosevelt was the last to survive it in the Oval Office.Of course, the economy was in a recession when Obama took the oath of office and worsened before he could possibly have done anything to turn it around. But itís equally true that every month a president is in office, he takes on a little more ownership of the situation he inherited, whatever it is. By the time the incumbent gets four years in, if things are getting better, he will get credit or the blame, deserved or not. Reminders that it all went to hell on a different president and partyís watch doesnít change that.

If the economy is much different in October and November than now, itís more likely to be worse than better....

We are past the point where Obama can win a referendum election, regardless of whether it is on him or the economy.

His prescription for Obama is to go negative and poison Romney's image. It's the only play left to him.

Recent Comments

Hillary Clinton:

"Prince Andrew arrested.

Posted by: Auspex

----- ..."

man: "it was a political strategy to reshape AmericaR ..."

Lady in Black[/i][/b][/u][/s]: "Iowa and Oklahoma are delivering voters the opposi ..."

GWB: "Clean the voter rolls. Now. ..."

rickb223 [/b][/s][/u][/i]: "Morning all ..."

Auspex: " Prince Andrew arrested. ..."

Lady in Black[/i][/b][/u][/s]: " Always liked U2 up to the Zooropa album. Saw them ..."

Case: "I don't really give a sh*t what foreign people hav ..."

bill in arkansas, not gonna comply with nuttin, waiting for the 0300 knock on the door : "58 I don't know the names of the worms that reques ..."

Count de Monet: "Wolfus, do you qualify for one of the IRS' partner ..."

Huck Follywood: "Iowa and Oklahoma are delivering voters the opposi ..."

bear with asymmetrical balls: "It's not just that U2 sucks. Lots of bands do. U2 ..."

man: "it was a political strategy to reshape AmericaR ..."

Lady in Black[/i][/b][/u][/s]: "Iowa and Oklahoma are delivering voters the opposi ..."

GWB: "Clean the voter rolls. Now. ..."

rickb223 [/b][/s][/u][/i]: "Morning all ..."

Auspex: " Prince Andrew arrested. ..."

Lady in Black[/i][/b][/u][/s]: " Always liked U2 up to the Zooropa album. Saw them ..."

Case: "I don't really give a sh*t what foreign people hav ..."

bill in arkansas, not gonna comply with nuttin, waiting for the 0300 knock on the door : "58 I don't know the names of the worms that reques ..."

Count de Monet: "Wolfus, do you qualify for one of the IRS' partner ..."

Huck Follywood: "Iowa and Oklahoma are delivering voters the opposi ..."

bear with asymmetrical balls: "It's not just that U2 sucks. Lots of bands do. U2 ..."

Recent Entries

The Morning Report — 2/19/26

Daily Tech News 19 February 2026

Wednesday Overnight Open Thread - February 18, 2026 [TRex]

Handicapable Hounds Cafe

Quick Hits

As the Communist Cuban Junta Enters End-of-Life Care, Marco Rubio Begins Secretly Talking to Raul Castro's Grandson About a Living Will

Surprise! Harvard Refuses to Obey the Supreme Court Ruling Outlawing Race Discrimination in Admissions. All They've Done Is End Discrimination Against Asians -- and Doubling Up on Anti-White Discrimination

It Begins: Canada Now Murdering People For Minor Ailments, Just As Predicted

Democrat Snake Ted Lieu: The Epstein Files, Which Are Filled with Disproven False Tips About Everyone, Show That Trump was Raping Children

Democrats Demand Censure for Congressman Randy Fine Due to His Protection of Dogs From Arrogant Foreign Colonizers

Daily Tech News 19 February 2026

Wednesday Overnight Open Thread - February 18, 2026 [TRex]

Handicapable Hounds Cafe

Quick Hits

As the Communist Cuban Junta Enters End-of-Life Care, Marco Rubio Begins Secretly Talking to Raul Castro's Grandson About a Living Will

Surprise! Harvard Refuses to Obey the Supreme Court Ruling Outlawing Race Discrimination in Admissions. All They've Done Is End Discrimination Against Asians -- and Doubling Up on Anti-White Discrimination

It Begins: Canada Now Murdering People For Minor Ailments, Just As Predicted

Democrat Snake Ted Lieu: The Epstein Files, Which Are Filled with Disproven False Tips About Everyone, Show That Trump was Raping Children

Democrats Demand Censure for Congressman Randy Fine Due to His Protection of Dogs From Arrogant Foreign Colonizers

Search

Polls! Polls! Polls!

Frequently Asked Questions

The (Almost) Complete Paul Anka Integrity Kick

Primary Document: The Audio

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Top Top Tens

Democratic Forays into Erotica

New Shows On Gore's DNC/MTV Network

Nicknames for Potatoes, By People Who Really Hate Potatoes

Star Wars Euphemisms for Self-Abuse

Signs You're at an Iraqi "Wedding Party"

Signs Your Clown Has Gone Bad

Signs That You, Geroge Michael, Should Probably Just Give It Up

Signs of Hip-Hop Influence on John Kerry

NYT Headlines Spinning Bush's Jobs Boom

Things People Are More Likely to Say Than "Did You Hear What Al Franken Said Yesterday?"

Signs that Paul Krugman Has Lost His Frickin' Mind

All-Time Best NBA Players, According to Senator Robert Byrd

Other Bad Things About the Jews, According to the Koran

Signs That David Letterman Just Doesn't Care Anymore

Examples of Bob Kerrey's Insufferable Racial Jackassery

Signs Andy Rooney Is Going Senile

Other Judgments Dick Clarke Made About Condi Rice Based on Her Appearance

Collective Names for Groups of People

John Kerry's Other Vietnam Super-Pets

Cool Things About the XM8 Assault Rifle

Media-Approved Facts About the Democrat Spy

Changes to Make Christianity More "Inclusive"

Secret John Kerry Senatorial Accomplishments

John Edwards Campaign Excuses

John Kerry Pick-Up Lines

Changes Liberal Senator George Michell Will Make at Disney

Torments in Dog-Hell

Greatest Hitjobs

The Ace of Spades HQ Sex-for-Money Skankathon

A D&D Guide to the Democratic Candidates

Margaret Cho: Just Not Funny

More Margaret Cho Abuse

Margaret Cho: Still Not Funny

Iraqi Prisoner Claims He Was Raped... By Woman

Wonkette Announces "Morning Zoo" Format

John Kerry's "Plan" Causes Surrender of Moqtada al-Sadr's Militia

World Muslim Leaders Apologize for Nick Berg's Beheading

Michael Moore Goes on Lunchtime Manhattan Death-Spree

Milestone: Oliver Willis Posts 400th "Fake News Article" Referencing Britney Spears

Liberal Economists Rue a "New Decade of Greed"

Artificial Insouciance: Maureen Dowd's Word Processor Revolts Against Her Numbing Imbecility

Intelligence Officials Eye Blogs for Tips

They Done Found Us Out, Cletus: Intrepid Internet Detective Figures Out Our Master Plan

Shock: Josh Marshall Almost Mentions Sarin Discovery in Iraq

Leather-Clad Biker Freaks Terrorize Australian Town

When Clinton Was President, Torture Was Cool

What Wonkette Means When She Explains What Tina Brown Means

Wonkette's Stand-Up Act

Wankette HQ Gay-Rumors Du Jour

Here's What's Bugging Me: Goose and Slider

My Own Micah Wright Style Confession of Dishonesty

Outraged "Conservatives" React to the FMA

An On-Line Impression of Dennis Miller Having Sex with a Kodiak Bear

The Story the Rightwing Media Refuses to Report!

Our Lunch with David "Glengarry Glen Ross" Mamet

The House of Love: Paul Krugman

A Michael Moore Mystery (TM)

The Dowd-O-Matic!

Liberal Consistency and Other Myths

Kepler's Laws of Liberal Media Bias

John Kerry-- The Splunge! Candidate

"Divisive" Politics & "Attacks on Patriotism" (very long)

The Donkey ("The Raven" parody)