Intermarkets' Privacy Policy

Donate to Ace of Spades HQ!

aceofspadeshq at gee mail.com

Buck:

buck.throckmorton at protonmail.com

CBD:

cbd at cutjibnewsletter.com

joe mannix:

mannix2024 at proton.me

MisHum:

petmorons at gee mail.com

J.J. Sefton:

sefton at cutjibnewsletter.com

Golden Hour Cafe

BREAKING: DEMOCRAT TERRORISTS CRASH STOLEN AMBULANCE LOADED WITH GAS CANS INTO AN IDAHO FEDERAL BUILDING

Quick Hits

The Demonic Drunkard Tucker Carlson Spins His Most Brazen Lie Yet, Claiming He Was "Detained" by Evil Jews in Israel

The Atlantic Publishe a Viral "Report" Account of a Boy Dying of Measles Because His Parents Didn't Vaccinate Him.

One Small Problem: The "Report" Is Actually Fiction, a "Hypothetical" Morality Play But That Atlantic Presented It As Actual Truth.

11 Arrested in Antifa Lynching Murder of Young Man Protecting Women from Muslim Thugs;

One of the Killers is Legislative Aide to Far-Left Member of French Assembly

One of Epstein's Recruiters Decided to Inform On Him to the Police, and Epstein Schemed to Give Him a $3 Million Bribe to Keep Quiet;

He Discussed the Plan with Obama WH Counsel and Friend of Jeff Kathyrine Ruemmler

LOL: Anderson Pooper's Team Rushes to the Media to Claim He Wasn't Pushed Out, He Quit on Prinzibuhls

Andrew Mountbatten-Windsor Arrested, Has Home Searched; Suspected of, Get This, Passing Sensitive Insider Trade Information to International Financier and Child Sex Trafficker Jeffrey Epstein

Jim Sunk New Dawn 2025

Jewells45 2025

Bandersnatch 2024

GnuBreed 2024

Captain Hate 2023

moon_over_vermont 2023

westminsterdogshow 2023

Ann Wilson(Empire1) 2022

Dave In Texas 2022

Jesse in D.C. 2022

OregonMuse 2022

redc1c4 2021

Tami 2021

Chavez the Hugo 2020

Ibguy 2020

Rickl 2019

Joffen 2014

maildrop62 at proton dot me

Gallup: 48% Find Tax Burden Just About Right

Gallup forgets to mention an important fact: 38% pay no income taxes whatsoever. Add them into another 10% who pay a trivial amount, and you can easily understand why they're so psyched about the current tax code, and don't mind "the rich" (i.e., the other 52%) paying more.

There's another point here too: Observe the graph. When was it that this sea-change in the public's attitude about tax burdens actually occurred?

Yes, that's correct: The public went from thinking their taxes were too high to about right at the exact same time as Bush's 2001 tax cuts.

He deserves credit for that -- if credit is indeed due. Personally, I thought then -- and think even more strongly now -- that while removing millions of taxpayers from the tax rolls and cutting down to almost nothing the taxes paid by millions more was popular, Bush actually cut lower- and middle- class taxes too much, to the point where nearly half the country had no stake in the tax rate argument whatsoever. (By the way, I also think he cut taxes on the highest bracket by a point or two too much.) *

It's impolitic as hell to suggest it, but Ari Fleisher is right: Almost everyone should pay some amount in income taxes, even if it's a trivial amount, if only to not divide the public absolutely between tax-payers and tax-consumers.

Gallup also tries the spin the poll as somehow a positive reflection on Obama's policies. But note, again, the chart: The major change in the balance of opinion occurred due to Bush's tax code changes, with only the most trivial shifting of a point here and two points there since. Here's Gallup:

Since 1956, there has been only one other time when a higher percentage of Americans said their taxes were about right -- in 2003, when 50% did so after two rounds of tax cuts under the Bush administration.The slightly more positive view this year may reflect a public response to President Barack Obama's economic stimulus and budget plans. He has promised not to raise taxes on Americans making less than $250,000, while cutting taxes for lower- and middle-income Americans. The latter has already begun, as the government has reduced the withholding amount for federal income taxes from middle- and lower-income American workers' paychecks.

Later, Gallup opines:

As the remaining U.S. tax filers prepare to send their income-tax returns before the April 15 deadline, Gallup finds Americans' views of their federal income taxes about as positive as at any point in the last 60 years. This may reflect the income-tax cut that was part of the $787 billion economic stimulus plan, as well as a continuing sense of patriotism with the country fighting two wars.

The income tax cut that was part of Obama's stimulus was, what, that $13 per week cut for some tax payers? Gallup is pretty sure that that's the cause of the current mood on taxes, rather than the huge cuts Bush enacted.

This is some seriously strained analysis. Gallup bends over backwards to credit minor shifts in opinion to Barack Obama's prospective, hypothetical future tax cuts (which will remain purely hypothetical, of course) while studiously ignoring the major impact of Bush's actual tax cuts. Current attitudes about taxation should be shaped mostly by actual current taxation levels, no? And yet in Gallup's view, it's a toss-up as to whether opinions are more shaped by Bush's actual, real, on-the-books tax cuts, or Obama's imaginary future tax cuts.

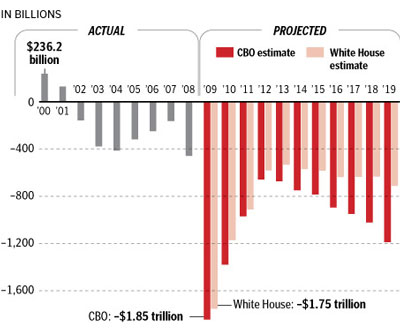

And they are purely imaginary, wholly fantastical. Obama's not going to cut taxes for the middle class. He has created a staggering, unprecedentedly large, jaw-dropping, eye-popping structural deficit...

...that can only be reduced by going where the money is: The middle class, which has both the huge numbers of tax-filers to make a difference, as well as enough money to pay more.

The poor have the numbers but not the money, the rich have the money but not the numbers. Only the middle class has that wonderful combination of big numbers and ample income.

Yes, it's coming. As the ship's architect said in Titanic about the sinking of the ship: It is purely a simple mathematical problem at this point with only one solution. "It is made of iron; I assure you, it will sink."

The Obama administration will be hard-pressed to avoid raising taxes on the middle class, according to economists crunching federal budget numbers in the lead-up to tax return day — today, April 15.President Obama’s proposed changes to the tax code, combined with exploding entitlement costs, will lead to ever-growing debt, according to independent estimates. The big question for Obama and his economic team will be whether he can meet the rising costs with increased tax revenue only from small slices of the electorate. …

“You just simply can’t tax the rich enough to make this all up,” said Martin A. Sullivan, a former economic aide in the Reagan administration who said he backed Obama last fall.

“Especially just for getting the budget to a sustainable level, there needs to be a broad-based tax increase,” said Sullivan, now a contributing editor at Tax Analysts publications. “If you want to do healthcare on top of that, almost certainly, it just makes [a middle-class tax increase] all the more certain.”

This is the most bizarre part of Gallup's analysis, crediting Obama with the public's less-peevish mood about the tax code. If they're happy now, that means they won't be happy with changes, changes that can be made in only one direction -- increasing taxation. If they're content now, that means they will be less content as Obama raises taxes, as he has deliberately overspent to be "forced" to do.

Gallup knows this, and knows that the public's less-disgruntled mood on taxes should not be taken as some sort of endorsement of Obama, but rather a large warning to Obama should he begin undoing the very tax cuts -- Bush's -- that created the generally positive public mood on taxes in the first place. Bush created the tax tranquility (pax tax?); Obama will undo it; and yet Obama is somehow to be credited for it.

What?

Thanks to Warden.

* I think he got to fixated on having tax rates set at multiples of five -- 10, 15, 35... If it were 11, 16, and 36, he might have avoided most of his own much-smaller structural deficit. Yes, that's a point higher and all -- but still a tax cut, and without as much of a built-in structural deficit, which was used an issue against him, again and again.

Back when a $350 billion structural deficit actually mattered. Now, of course, Obama sells us $1+ trillion deficits per year and we're told it's no big deal.

Tonypete: "Good evening good people. ..."

JohnFNotKerry: "What idiot came up with the new thing where clicki ..."

Madge: "Content? You're soaking in it. ..."

Heirloominati: "If you're a baseball fan and you've never been to ..."

Lurking Cheshirecat: "Meow ..."

mindful webworker is here: "Y'know, I'd say I miss WeirdDave's Thursday ONTs, ..."

mindful webworker is here: "Almost ..."

purely an academic question: "1st? ..."

CharlieBrown'sDildo: "Is it supposed to be difficult to get a first? ..."

Mr Aspirin Factory, diseased garbage human: "RIP Mike Wagner, Steelers safety during the 70's S ..."

Anna Puma: "He probably couldn't find a hobby store that sold ..."

Golden Hour Cafe

BREAKING: DEMOCRAT TERRORISTS CRASH STOLEN AMBULANCE LOADED WITH GAS CANS INTO AN IDAHO FEDERAL BUILDING

Quick Hits

The Demonic Drunkard Tucker Carlson Spins His Most Brazen Lie Yet, Claiming He Was "Detained" by Evil Jews in Israel

The Atlantic Publishe a Viral "Report" Account of a Boy Dying of Measles Because His Parents Didn't Vaccinate Him.

One Small Problem: The "Report" Is Actually Fiction, a "Hypothetical" Morality Play But That Atlantic Presented It As Actual Truth.

11 Arrested in Antifa Lynching Murder of Young Man Protecting Women from Muslim Thugs;

One of the Killers is Legislative Aide to Far-Left Member of French Assembly

One of Epstein's Recruiters Decided to Inform On Him to the Police, and Epstein Schemed to Give Him a $3 Million Bribe to Keep Quiet;

He Discussed the Plan with Obama WH Counsel and Friend of Jeff Kathyrine Ruemmler

LOL: Anderson Pooper's Team Rushes to the Media to Claim He Wasn't Pushed Out, He Quit on Prinzibuhls

Andrew Mountbatten-Windsor Arrested, Has Home Searched; Suspected of, Get This, Passing Sensitive Insider Trade Information to International Financier and Child Sex Trafficker Jeffrey Epstein

Paul Anka Haiku Contest Announcement

Integrity SAT's: Entrance Exam for Paul Anka's Band

AllahPundit's Paul Anka 45's Collection

AnkaPundit: Paul Anka Takes Over the Site for a Weekend (Continues through to Monday's postings)

George Bush Slices Don Rumsfeld Like an F*ckin' Hammer

Democratic Forays into Erotica

New Shows On Gore's DNC/MTV Network

Nicknames for Potatoes, By People Who Really Hate Potatoes

Star Wars Euphemisms for Self-Abuse

Signs You're at an Iraqi "Wedding Party"

Signs Your Clown Has Gone Bad

Signs That You, Geroge Michael, Should Probably Just Give It Up

Signs of Hip-Hop Influence on John Kerry

NYT Headlines Spinning Bush's Jobs Boom

Things People Are More Likely to Say Than "Did You Hear What Al Franken Said Yesterday?"

Signs that Paul Krugman Has Lost His Frickin' Mind

All-Time Best NBA Players, According to Senator Robert Byrd

Other Bad Things About the Jews, According to the Koran

Signs That David Letterman Just Doesn't Care Anymore

Examples of Bob Kerrey's Insufferable Racial Jackassery

Signs Andy Rooney Is Going Senile

Other Judgments Dick Clarke Made About Condi Rice Based on Her Appearance

Collective Names for Groups of People

John Kerry's Other Vietnam Super-Pets

Cool Things About the XM8 Assault Rifle

Media-Approved Facts About the Democrat Spy

Changes to Make Christianity More "Inclusive"

Secret John Kerry Senatorial Accomplishments

John Edwards Campaign Excuses

John Kerry Pick-Up Lines

Changes Liberal Senator George Michell Will Make at Disney

Torments in Dog-Hell

The Ace of Spades HQ Sex-for-Money Skankathon

A D&D Guide to the Democratic Candidates

Margaret Cho: Just Not Funny

More Margaret Cho Abuse

Margaret Cho: Still Not Funny

Iraqi Prisoner Claims He Was Raped... By Woman

Wonkette Announces "Morning Zoo" Format

John Kerry's "Plan" Causes Surrender of Moqtada al-Sadr's Militia

World Muslim Leaders Apologize for Nick Berg's Beheading

Michael Moore Goes on Lunchtime Manhattan Death-Spree

Milestone: Oliver Willis Posts 400th "Fake News Article" Referencing Britney Spears

Liberal Economists Rue a "New Decade of Greed"

Artificial Insouciance: Maureen Dowd's Word Processor Revolts Against Her Numbing Imbecility

Intelligence Officials Eye Blogs for Tips

They Done Found Us Out, Cletus: Intrepid Internet Detective Figures Out Our Master Plan

Shock: Josh Marshall Almost Mentions Sarin Discovery in Iraq

Leather-Clad Biker Freaks Terrorize Australian Town

When Clinton Was President, Torture Was Cool

What Wonkette Means When She Explains What Tina Brown Means

Wonkette's Stand-Up Act

Wankette HQ Gay-Rumors Du Jour

Here's What's Bugging Me: Goose and Slider

My Own Micah Wright Style Confession of Dishonesty

Outraged "Conservatives" React to the FMA

An On-Line Impression of Dennis Miller Having Sex with a Kodiak Bear

The Story the Rightwing Media Refuses to Report!

Our Lunch with David "Glengarry Glen Ross" Mamet

The House of Love: Paul Krugman

A Michael Moore Mystery (TM)

The Dowd-O-Matic!

Liberal Consistency and Other Myths

Kepler's Laws of Liberal Media Bias

John Kerry-- The Splunge! Candidate

"Divisive" Politics & "Attacks on Patriotism" (very long)

The Donkey ("The Raven" parody)